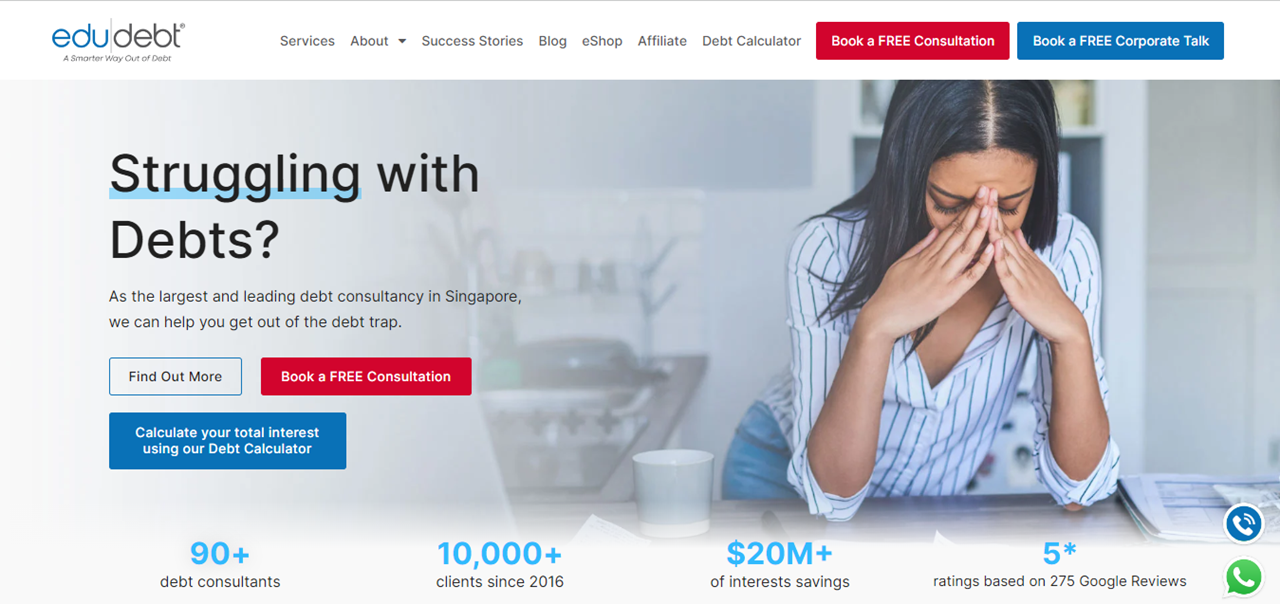

Debt repayment can often feel like navigating through uncharted waters, filled with uncertainty and stress. However, with the right expertise and guidance, managing debt can become a manageable and empowering journey. EDUdebt offers individuals the tools and resources they need to navigate debt repayment with confidence, helping them take control of their finances and work towards a debt-free future. In this article, we’ll explore how EDUdebt’s expertise can empower individuals to tackle their debts effectively and achieve financial stability.

Contents

Understanding the Challenge of Debt Repayment

Before delving into solutions, it’s crucial to understand the challenges individuals face when it comes to debt repayment. Debt can come in various forms, from credit card balances to student loans and mortgages. High-interest rates, minimum payments, and varying repayment terms can make it difficult to make meaningful progress towards paying off debt, leaving individuals feeling overwhelmed and trapped in a cycle of financial stress.

Psychological Impact

Beyond the financial burden, debt can also have a significant psychological impact on individuals. The stress and anxiety associated with debt can affect mental health, relationships, and overall well-being. Without proper support and guidance, individuals may struggle to cope with the emotional toll of debt repayment, further hindering their progress towards financial stability.

EDUdebt’s Approach to Debt Repayment

EDUdebt understands the challenges individuals face when dealing with debt and offers a holistic approach to debt repayment that addresses both the financial and psychological aspects of the journey.

Comprehensive Debt Assessment

The first step in navigating debt repayment with confidence is gaining a clear understanding of your financial situation. EDUdebt at https://www.edudebt.sg/ offers comprehensive debt assessment tools that analyze your total debt load, interest rates, and repayment terms. This assessment provides valuable insight into your financial health and forms the foundation for creating a customized debt repayment plan.

Personalized Debt Management Plans

No two individuals are alike, which is why EDUdebt offers personalized debt management plans tailored to your unique financial situation and goals. These plans take into account factors such as income, expenses, and debt levels to create a realistic and achievable strategy for paying off debt. Whether it’s prioritizing debts, negotiating with creditors, or consolidating loans, EDUdebt provides the guidance and support you need to navigate debt repayment with confidence.

Budgeting and Financial Planning

Effective budgeting is key to managing debt and achieving financial stability. EDUdebt offers powerful budgeting tools and resources that help you track income and expenses, set savings goals, and monitor your progress over time. By creating a realistic budget and sticking to it, you can take control of your finances and make meaningful progress towards debt repayment.

Building Confidence and Resilience

Beyond practical solutions, EDUdebt also focuses on building confidence and resilience in individuals as they navigate the challenges of debt repayment.

Financial Education and Empowerment

EDUdebt provides ongoing financial education and empowerment to help individuals build the knowledge and skills needed to succeed. Whether it’s learning about debt management strategies, understanding credit scores, or exploring investment options, EDUdebt offers a wealth of resources to help you make informed decisions about your finances.

Emotional Support and Counseling

Debt repayment can be emotionally challenging, which is why EDUdebt offers emotional support and counseling services to help individuals cope with the stress and anxiety associated with debt. By providing a supportive and understanding environment, EDUdebt empowers individuals to overcome emotional barriers and stay motivated on their journey towards financial freedom.

Conclusion: Empowering Individuals to Thrive

Navigating debt repayment can be daunting, but with EDUdebt’s expertise and support, individuals can tackle their debts with confidence and determination. By offering personalized solutions, expert guidance, and emotional support, EDUdebt empowers individuals to take control of their finances and work towards a debt-free future. Don’t let debt hold you back – with EDUdebt by your side, you can navigate debt repayment with confidence and build a brighter financial future for yourself and your family.